3 Tips to Navigating High Mortgage Rates and Securing Your Dream Home

Planning to dive into the home-buying journey, but the looming high mortgage rates have you feeling hesitant? Don't worry, you're not alone.

Let's break down the current scenario, break down the rates, and explore how you can still score a reasonable mortgage.

Decoding High Mortgage Rates: A Closer Look

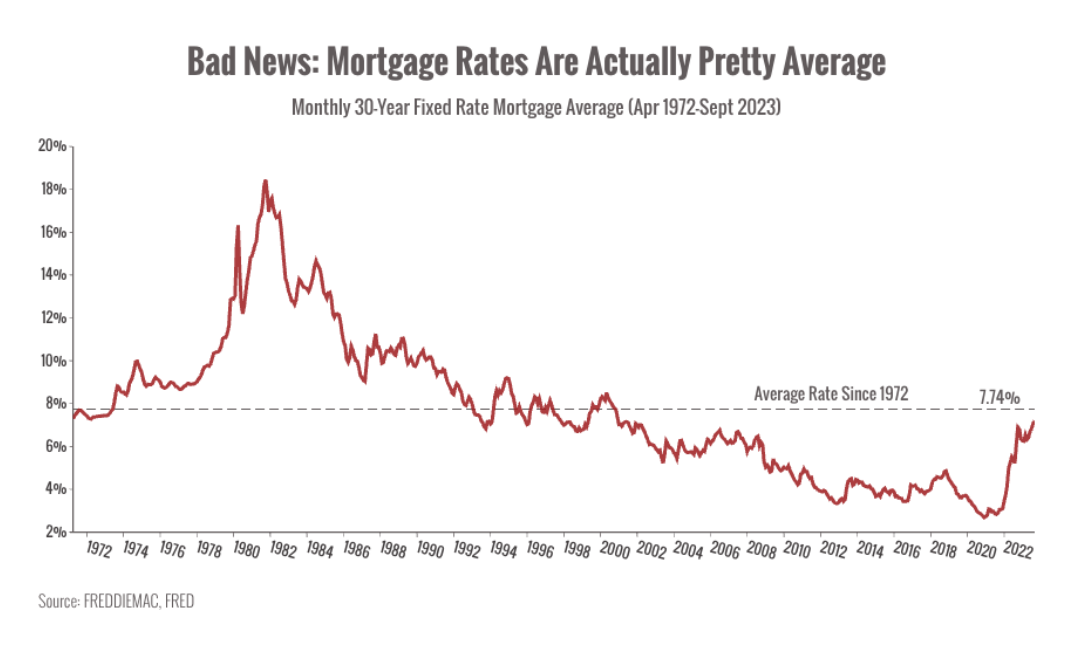

So, the rates are hovering above 7%, and it might seem like a daunting obstacle. The truth is, in the grand scheme of things, these rates aren't historically outrageous. Our perception is skewed by the prolonged era of low rates we've grown accustomed to. But here's the silver lining: as a buyer, you've got more leverage than you might realize.

Turning the Tides in Your Favor: 3 Tips for Mortgage Success

- Shop Around, Always: Sure, your real estate agent might have a preferred lender, but rates can vary significantly. Don't settle; shop around. Research shows that comparing at least four rate quotes could save you over $1,200 annually. Look beyond the interest rate; consider the annual percentage rate (APR) for a more comprehensive view.

- Negotiate Fees Like a Pro: Once you've identified a lender or two, don't shy away from negotiation. Scrutinize loan estimates, and ask for written documentation if lenders are willing to beat competitors' offers. Leverage any existing relationship with a lender for better deals. You might even negotiate for a future no-cost refinance.

- Seek Seller Assistance: Closing costs can sneak up on you. Negotiate with sellers for closing credits or explore the possibility of a rate buy-down. This strategic move can significantly impact your out-of-pocket expenses. Understand the nuances between temporary and permanent buy-downs, considering the potential trade-offs.

Mastering the Art of Negotiation in a High-Rate Environment

Mortgage rates might be on the higher side, but you can still be a savvy negotiator. Arm yourself with these tips, and navigate the home-buying process with confidence. Thousands of dollars in savings await those who are proactive.

Ready to make your move? Let's do it together.